Take-home grocery sales increased by 5.4% in the four weeks to 18 February 2024, according to the latest data from Kantar, with grocery price inflation driving value sales growth rather than consumers buying more. In February, the average price per pack rose 3.7%, while volumes per trip fell this month by 3.1%. Frequency of trips continues to be a main contributor to the market’s growth, up 3% year-on-year.

Grocery inflation stands at 4.7% in the 12 weeks to 18 February 2024, this is down 1.2 percentage points versus January (5.9%) – the tenth month in a row that inflation has fallen.

Emer Healy, Business Development Director at Kantar, explains: “It's great news for Irish consumers as inflation levels have reached their lowest point since April 2022. This gradual decline is expected to continue throughout 2024.

“As consumers continue to closely manage their household budgets and look for the best value, it’s no surprise that own label goods continue to perform strongly. We saw this behaviour over the course of 2023 and it’s clear to see this is now a more established norm for shoppers into 2024.”

Own label now holds 46% market share as sales of own label ranges grow ahead of the total market at 7.5% year-on-year, with shoppers spending an additional €112m year-on-year. Premium own-label ranges are performing strongly with shoppers spending an additional €19m on these lines, a 12.5% increase compared to this time last year. Sales of brand goods were also up 4.7% over the 12 weeks, growing slightly behind the total market.

Promotional levels increased after the post-Christmas slowdown as retailers looked for ways to encourage shoppers through their doors. Over 27% of all spend in the 12 weeks to 18 February 2024 was made on items with some promotional offer, up 3.9% versus last year. Dunnes, Tesco, Aldi and Lidl all saw strong growth in sales on promotion ahead of the total market.

Love is in the air

“Love was most definitely in the air for Irish consumers this month with over 58% of Irish households purchasing boxed and gifting chocolates over the 12 weeks to 18 February 2024,” adds Emer Healy. “We saw volumes of boxed and gifting chocolates up 3.7%, with shoppers spending an additional €1.7 million year-on-year. As Valentine’s Day fell mid-week this year and many shoppers managing household budgets, some people chose to show their love at home. Shoppers spent an additional €4.3 million on chilled ready meals, €1.8 million on chilled desserts and €916k on sparkling wine.”

Valentine’s Day wasn’t the only celebration in February with many Irish shoppers indulging in Pancake Tuesday, which saw shoppers spend a combined additional €2 million on flour, eggs and chocolate spread.

Online sales were up 17.3% year-on-year with shoppers spending an additional €28.3 million online versus last year. The main contributor to this performance was more frequent trips, which contributed an additional €7.7m. Alongside frequency, the online channel continues to attract new shoppers with 18.4% of Irish households purchasing groceries online alongside picking up slightly more volume, up 0.5% year-on-year.

Irish retailer performance update

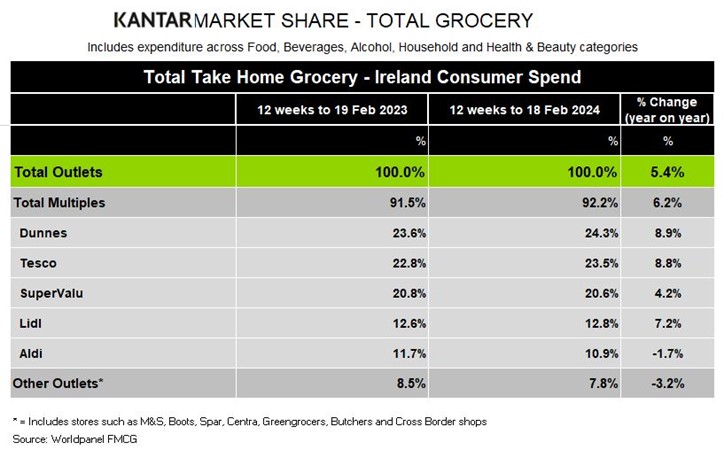

Dunnes, Tesco and Lidl all grew ahead of the total market in terms of value this month.

Dunnes has 24.3% market share with growth of 8.9% year-on-year. This growth stems through more frequent trips, up 5.9%, which contributed an additional €46.7 million to the overall performance.

Tesco holds 23.5% of the market, up 8.8% year-on-year. Tesco saw the strongest frequency growth amongst all retailers for another month in a row, up 12.4% year-on-year, which combined contributed an additional €91.8 million to the overall performance.

SuperValu holds 20.6% of the market and growth of 4.2%. SuperValu shoppers make the most trips in-store when compared to all retailers, an average of 20.9 trips.

Lidl has 12.8% share with growth of 7.2% year-on-year. More frequent trips contributed an additional €34.7 million to the retailer’s overall performance. Aldi holds 10.9% market share with more frequent trips and new shopper arrivals contributing an additional €5.2 million to the overall performance.