Following a period of festive spending and seasonal celebrations, shoppers in Ireland continued to spend despite Dry January replacing New Year celebrations. The latest Irish grocery data from Kantar shows that take-home value sales over the four weeks to 26 January 2025 increased by 6.5% compared to the same period last year. This was despite grocery price inflation increasing 3.4%, slightly lower than last month.

January also saw shoppers returning to store more often, making on average 23 trips to store but picking up less volume per trip, which was down 1.6% versus last year.

“Supermarkets were rolling out discounts in the New Year, as a way of easing the pressure on household budgets – and Irish consumers were more than happy to take advantage of them,” according to Emer Healy, Business Development Director at Kantar. “Spending on promotion rose by 8.4% with shoppers spending an additional €72 million versus last year. This is the highest level of sales on promotion we’ve seen since February 2021.”

Alongside promotions Irish shoppers turned to own label products to help keep costs down in January. Sales of own label products jumped 6.9% compared to last year with an additional €103.9 million being spent on these ranges. Overall own label holds 44% value market share. Brands also saw growth this year, albeit behind the total market at 5.3% compared to last year.

A dry start to the year

Shoppers focused as much on health and wellness as on their wallets with an additional €8.9 million spent on fresh fruit and vegetables combined. January also saw a boost in healthcare, up 8.6%. compared the same period to last year.

Emer Healy adds: “Dry January was in full swing this year with 6.2% of all Irish households purchasing non-alcoholic drinks in January. Sales of low and no-alcohol soared by over 47% with shoppers spending an additional €620k during the month versus last year.

“However, not everyone took part in Dry January this year as shoppers also spent an additional €7 million on Beer & Cider.”

Online sales rose by 14.5% year-on-year, with shoppers spending an additional €27.4 million through this channel. Over the latest 12-week period, the number of online shopping trips increased by 11.7%, while new shopper recruits arrived at online with over 19% of Irish households purchasing online.

Storm Éowyn drives grocery sales surge in Ireland

At the end of January, Ireland experienced Storm Éowyn, the most powerful storm in years. It marked the first nationwide red warning since 2017. The storm also impacted shopping habits, with consumers stocking up on necessities, leading to Tesco (+8.9%), Dunnes (+8.1%), and SuperValu (+8.5%) outperforming the total market throughout January (+6.5%). This impact will also be evident in grocers' performance within our 12-week data up to January 2025.

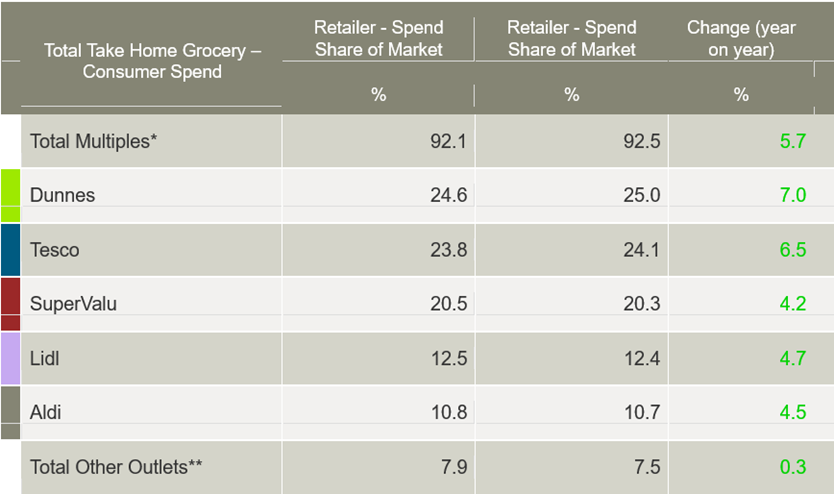

Over the latest 12 weeks, Dunnes holds a new record 25% market share, with a sales growth of 7% year-on-year. Shoppers increased the number of trips while picking up more packs per trip, which contributed a combined €39.2 million to their overall performance.

Tesco holds 24.1% of the market, with value growth of 6.5% year-on-year. Shoppers increased their trips to store alongside welcoming new shoppers, which contributed a combined €21 million to overall performance.

SuperValu holds 20.3% of the market with growth of 4.2%. Consumers made the most shopping trips to this grocer, averaging 23.8 trips over the latest 12 weeks. This increase in the number of shopping trips contributed an additional €40 million to its performance and strengthened results at the start of 2025.

Lidl holds a 12.4% share of total spending up 4.7%. Increased trips to store and new shopper arrivals drove an additional €8.7 million in sales. Aldi holds 10.7% market share up 4.5% versus last year with an increase in trips contributing an additional €13.3 million to its performance.